Mapping the Wave of Industry Digitalization by Co-Word Analysis: An Exploration of Four Disruptive Industries

Abstract

This paper aims to identify global digital trends across industries and to map emerging business areas by co-word analysis. As the industrial landscape has become complex and dynamic due to the rapid pace of technological changes and digital transformation, identifying industrial trends can be critical for strategic planning and investment policy at the firm and regional level. For this purpose, the paper examines industry and technology profiles of top startups across four industries (i.e. education, finance, healthcare, manufacturing) using CrunchBase metadata for the period 2016–2018 and studies in which subsector early-stage firms bring digital technologies on a global level. In particular, we apply word co-occurrence analysis to reveal which subindustry and digital technology keywords/keyphrases appear together in startup company classification. We also use network analysis to visualize industry structure and to identify digitalization trends across sectors. The results obtained from the analysis show that gamification and personalization are emerging trends in the education sector. In the finance industry, digital technologies penetrate in a wide set of services such as financial transactions, payments, insurance, venture capital, stock exchange, asset and risk management. Moreover, the data analyses indicate that health diagnostics and elderly care areas are at the forefront of the healthcare industry digitalization. In the manufacturing sector, startup companies focus on automating industrial processes and creating smart interconnected manufacturing. Finally, we discuss the implications of the study for strategic planning and management.

1. Introduction

Digital technologies disrupt markets and radically restructure entire industries [Nylénand Holmström (2015); Savastano et al. (2018); Rof et al. (2020); Hanelt et al. (2021); Fernández-Rovira et al. (2021); Yang et al. (2021); Tavoletti et al. (2021)]. In particular, emerging digital technologies have the potential not only to make obsolete existing products and services but also to threaten firms’ key business elements such as strategy, business model and organizational structure [Li et al. (2009); Yoo et al. (2012); Matt et al. (2015); Savastano et al. (2018); Reis et al. (2018); Rachinger et al. (2019); Hanelt et al. (2021); Coskun-Setirek and Tanrikulu (2021); Sjödin et al. (2021)] Given a rapidly changing digital innovation landscape and the complex dynamic nature of market development, many companies fail to keep pace with the new digital reality and to retain competitiveness [Hess et al. (2016); Coccia (2017a, 2017b); Reis et al. (2018); Müller et al. (2018); Seibt et al. (2019); Duan et al. (2019)]. As emerging digital technologies stimulate the creation of new applications and business models at an unprecedented speed, it becomes challenging for organizations to identify industry trends and emerging business areas. This further leads to difficulties in their strategic decision-making about which strategic options to implement and which technologies and business areas to focus investment on [Phaal et al. (2011); Matt et al. (2015); Hess et al. (2016); Hanelt et al. (2021)]. For this reason, understanding in which subsectors emerging digital technologies are penetrating and the nature of competitive changes they bring on the market can be critical for firms, especially in order to learn to adapt new competitive landscape and to adjust to digital transformation across industries.

Prior research utilizes case studies to learn digital trends across industries by interviewing business leaders [Liu et al. (2011); Horlacher and Hess (2016); Savastano et al. (2018); Demlehner et al. (2021); Kraus et al. (2021)]. However, while a case study can provide some in-depth analysis of the current state and specific nature of digital transformation in a sector, it usually lacks bases for generalizing results to a much broader population [Kraus et al. (2021); Massaro (2021)]. Another strand of literature uses patent and scientific publication data analysis to detect technology trends [Yoon and Kim (2011); Choi et al. (2012); Guo et al. (2016); Kim et al. (2016); Massaro (2021)], but the actual disruption of businesses and value networks across industries comes not from inventions and new emerging technologies but from the way entrepreneurs deploy them to create novel applications and business models [Paap and Katz (2004); Christensen et al. (2005); Lindholm-Dahlstrand et al. (2019)]. Specifically, Schumpeter [1934] views startup entrepreneurial firms as the main source through which new technologies enter in the market. As new entrepreneurial firms are at the forefront of innovation and they reshape markets and value networks across industries [Lindholm-Dahlstrand et al. (2019)], studying in which subsectors digital technology startups are operating and in which business areas they find new opportunities can be helpful to understand digital trends across industries and to map emerging sectors and business areas.

The main premises of our research constitute a word co-occurrence analysis to examine the distribution of digital technology-based startups across sub-sectors and to study industry digitalization trends. Specifically, using the CrunchBase database, we analyze industry and technology classifications of top startup companies at a global level. By applying a co-word analysis, we count the frequency of keywords or key phrases related to industry and technology categories appearing in startup companies’ classifications and build co-occurrence matrix to connect keywords and identify the strength of associations between them based on their co-occurrence in startup companies’ classifications; the keywords appearing in the same category is an indicator of connection between the sector and technology they represent [Lee and Jeong (2008); Chen et al. (2016)]. After that, by using keywords related to industry and technology categories as nodes and co-occurrences as links, we build keyword networks to visualize industry trends and emerging business areas across different sectors globally. On an industrial level, we apply a co-word analysis on education, finance, healthcare and manufacturing industries because these sectors are identified as one of the most dynamic industries in terms of business disruption and discontinuities that were caused by digital technologies [Bradley et al. (2015)]. The result obtained from the analysis shows that startup companies focus on creating personalized and game-based learning systems in the education sector. In the finance industry, digital technologies penetrate in a wide set of services like financial transactions, payments, insurance, venture capital, stock exchange, asset and risk management. In the healthcare sector, health diagnostics and elderly care areas are at the forefront of the industry’s digitalization. In the manufacturing sector, startup companies focus on automating industrial processes and creating smart interconnected manufacturing.

The rest of the paper is organized in the following way. Section 2 reviews the related literature and provides a theoretical framework. Section 3 presents the dataset and empirical methods used in the study. Section 4 discusses the findings from the empirical analysis, and, in the end, Sec. 5 summarizes and concludes.

2. Theoretical Framework

Digital technologies (e.g. the internet of things, cloud computing, blockchain, 3D technology, virtual reality, augmented reality, artificial intelligence (AI), machine learning) are computer-based products. In particular, they are electronic tools and systems that offer new solutions in the information storing and processing as well as provide new means in communication and connectivity in terms of linking devices and systems over the Internet or other communications networks and to exchange information [Remane et al. (2017); Savastano et al. (2018); Buer et al. (2018); Frank et al. (2019); Khujamatov et al. (2020); Borodavko et al. (2021); Chatterjee et al. (2021); Yang et al. (2021)]. In this way, the internet of things gives possibilities to integrate physical, digital and human assets of production processes and to merge them into cyber-physical systems [Frank et al. (2019); Alcácer and Cruz-Machado (2019)]. As a result, the interconnected business processes allow the communication between people, machines and products in real-time and generate a huge volume of structured and unstructured data. With the use of AI systems and machine learning algorithms, the interconnected cyber-physical systems are capable to analyze the generated data and to make their own automated decisions to optimize business processes [Kusiak (2017); Strange and Zucchella (2017); Lu (2017); Seibt et al. (2019); Baryannis et al. (2019); Cagliano et al. (2019); Dwivedi et al. (2021); Borodavko et al. (2021); Chatterjee et al. (2021)]. “Artificial intelligence refers to the ability of computer programs to acquire and apply knowledge without human intervention and involvement. By observing the world around them and analyzing information autonomously, AI systems draw conclusions and take appropriate actions” [Kaya (2019, p. 2)].

This complex process of combining digital technologies and business operation processes allow companies across different industries to replace traditional products with digital components or to equip them with new digital features and, as a result, to bring radically new value propositions to the market [Yoo et al. (2012); Bharadwaj et al. (2013); Matt et al. (2015); Reis et al. (2018); Rachinger et al. (2019); Rof et al. (2020); Sjödin et al. (2021); Coskun-Setirek and Tanrikulu (2021); Hanelt et al. (2021); Fernández-Rovira et al. (2021); Tavoletti et al. (2021)]. For instance, recent development trends in digital technologies in the healthcare industry like a mobile app, collection of health data and advanced data analytics based on AI and machine learning enable companies to provide remote monitoring, diagnostics and treatment to patients as well as to offer wearable robotic devices for self-care in order to facilitate home care service [Kraus et al. (2021); Massaro (2021)]. This also facilitates that developing virtual clinical trials as recent digital technologies allows us to remotely collect and analyze data in real time. Moreover, an increasing number of mobile health apps and developing electronic health record systems, in turn, generate a high volume of medical data that enable physicians to get data-driven insights and provide highly accurate health diagnoses [Coccia (2020); Massaro (2021)]. In other words, studying different types of patient data like medical records, treatment history, genetic characteristics, demographic and lifestyle information by AI systems and machine learning algorithms reduces the rate of medication errors and provides the most relevant patient health diagnosis and treatment plan [Coccia (2020)]. In this sense, emerging digital technologies stimulate the creation of new applications/business models and, consequently, substantially reshape industry competition and transform the global value chains as well as disrupt established businesses [Matt et al. (2015); Sebastian et al. (2017); Coccia (2017a, 2017b); Rof et al. (2020); Fernández-Rovira et al. (2021)]. ‘Digital disruptors are particularly dangerous because they grow enormous user bases seemingly overnight, and they are agile enough to convert those users into business models that threaten incumbents in multiple markets’ [Bradley et al. (2015, p. 1)]. Moreover, industry digitalization decreases entry barriers that allow startups to flourish and explore new business opportunities by leveraging digital technologies [Nambisan et al. (2018)].

In general, startup companies are considered to be vehicles for bringing radical innovations and new technologies to the market [Schumpeter (1934); LindholmDahlstrand et al. (2019)]. On the contrary, incumbent firms focus primarily on developing existing production processes because new technologies often do not support their value networks and complementary assets [Christensen (1997)]. Therefore, established companies have stronger incentives for developing incremental innovations and spreading costs of innovation over larger production volumes than introducing radical innovations which also involve uncertainties regarding the outcome [Klepper (1996)]. In other words, internal forces of inertia due to resource dependence and rigidity of their routines and competences as well as lack of economic incentives to invest in new value networks prevent established companies from entrepreneurial experimentation and exploring new market opportunities [Christensen (1997); LindholmDahlstrand et al. (2019)]. As new entrants usually face a lack of competences and advantages in exploiting mature technologies and existing production systems, they compete against established players by bringing novel ideas and technologies on the market [Lindholm-Dahlstrand et al. (2019)]. This process of introducing a variety of novel ideas and technologies on the market facilitates the operation of market selection mechanisms by picking up the most innovative companies and forcing established firms to become more productive and competitive [Wennekers and Thurik (1999)]. This, in turn, stimulates industry evolution by systematically replacing existing structures, values and actors.

Given that digital technologies also equip startup companies with new electronic tools and devices for information processing, computing, communication and connectivity [Nambisan et al. (2018)], new entrances increase market volatility, uncertainty, complexity, and ambiguity by challenging existing global industry ecosystems and forming new ones at unprecedented speed [Bradley et al. (2015)]. Hence, by leveraging digital technologies, startup companies increase uncertainty regarding predicting the potential disruptive power of new emerging technologies and business models. With all industrial sectors affected by the digital transformation, incumbent companies face pressure to tackle the challenges and to digitally transform themselves [Sebastian et al. (2017); Frank et al. (2019); Tavoletti et al. (2021); Fernández-Rovira et al. (2021)]. As processing massive amounts of external information and monitoring market trends are becoming increasingly difficult in an expanding global market, many established companies often fail to make right decisions of which strategic options to implement and which technological and business areas to focus investment on [Day and Schoemaker (2004); Phaal et al. (2011); Matt et al. (2015); Hess et al. (2016); Monteiro et al. (2017); Hanelt et al. (2021)]. This creates the need for analyzing the complex and dynamic processes of digital transformation across industries.

This research uses co-word analysis to reveal patterns and trends in industry digitalization and to study the nature and characteristics of this process across different sectors. Specifically, we analyze technology and industry classification of early-stage startups across sectors in order to identify the association links between digital technologies and subsectors.

3. Data and Methodology

Our empirical analysis, in this study, is based on technology and industry classification of startup companies operating in four different sectors. Specifically, to show the application of co-word analysis in detecting digital technology and business trends, we focus on those sectors which are considered as one of the most disrupted industries [Bradley et al. (2015)] such as (1) education, (2) finance, (3) healthcare and (4) manufacturing. We have extracted technology and industry classification of startup firms operating in the selected sectors in the world from the CrunchBase data source (https://www.crunchbase.com/) by using industry-related keywords (e.g. Education, Financial Services, Health Care, and Manufacturing).

CrunchBase is a platform that provides business information about firms all over the world, from the early-stage startups to the market leaders. The focus of our analysis is on the early-stage entrepreneurs. We classify early-stage entrepreneurs using the definition of Global Entrepreneurship Monitor, in which early-stage entrepreneurs are defined as those who started business activities in the last 24 months [GEM (2017)]. In this line of reasoning, we restricted our dataset to only those firms that started operations within two years, from November 2016 to November 2018; the database is extracted from the CrunchBase platform on December 15, 2018. Moreover, we use the technology and industry classification of only those startup firms that received funding or financial support in order to examine where top startups detect business opportunities across industries in the world. Using the elaborated criteria, we have identified 1,264 startups in the selected sectors. Table 1 presents the industrial distribution of our sample.

| Industry name | Number of startups |

|---|---|

| Education | 163 |

| Finance | 318 |

| Healthcare | 363 |

| Manufacturing | 420 |

To explore digitalization trends across the selected industries, we employ word co-occurrence analysis in order to examine which subsectors and digital technology keywords/keyphrases appear together in startup company classification. Sector and digital technology keywords co-occurring within the same startup business classification indicate a link between the keywords to which they represent [Lee and Jeong (2008); Chen et al. (2016)]. In the CrunchBase dataset, the technology and industry classification of each startup is described in the category section. For example, the category section of three startups in the healthcare sector would look like the following:

[“Artificial Intelligence”, “Health Care”, “Health Diagnostics”, “Machine Learning”, “Blockchain”, “Personalization”],

[“Mobile Health”, “Personal Health”, “Travel”, “Health Care”, “Heath Diagnostics”, “Medical”, “Information Technology”, “Artificial Intelligence”, “Machine Learning”],

[“Apps”, “Child Care”, “Elder Care”, “Health Care”, “Home Health Care”, “’Mobile Apps”, “Personal Health”, “Mobile Health”].

To implement the word co-occurrence analysis, we first tokenize keywords/keyphrases in the corpus of the category section using the NLTK package of Python program [Bird et al. (2009); Bengfort et al. (2018)]; the represented text does not require cleaning in terms of removing stop words, special characters, numbers or other text pre-processing procedures. Moreover, keywords 3D printing and 3D technology are used interchangeably in the category section of startup companies, and we converted 3D technology keywords to 3D printing as they are synonyms and represent the same technology. Then, we calculate the frequency values of digital technology keywords by counting the number of times each keyword appears in the category section of startup companies in the selected industries and divide the obtained values by the sample size to normalize frequency values, which allows the frequency values to be comparable across industries. Hence, the frequency values are computed as the ratio of the number of startup companies that mention a digital technology keyword in their category description to the number of possible startup companies that could mention the keyword. Finally, we use the NetworkX package of Python program to build a network of sub-sector and digital technology keywords [Bengfort et al. (2018); Zinoviev (2018)]. In the network, nodes represent subsector and digital technology keywords, and edges denote the co-occurrence between them.

The Python NetworkX package provides a collection of functions for calculating centrality measures of nodes in a network. In the study, we use degree centrality and betweenness centrality to describe the network positions of digital technologies across the selected industries (see Tables 2–5). Degree centrality is calculated by first computing the number of direct links a node has in a network and then dividing by the total number of possible direct links the node can have in the network to normalize values. Degree centrality measures the neighborhood size (degree) of each node [Marra et al. (2015)]. In our case, degree centrality is high for a digital technology keyword when the keyword co-occurs with many different terms in the text corpus.

| Digital technologies | Frequency | Degree centrality | Betweenness centrality |

|---|---|---|---|

| AI | 0.092 | 0.281 | 0.211 |

| Augmented reality | 0.036 | 0.125 | 0.035 |

| Blockchain | 0.018 | 0.096 | 0.045 |

| Internet of things | 0.006 | 0.037 | 0.0 |

| Machine learning | 0.036 | 0.111 | 0.059 |

| Virtual reality | 0.036 | 0.111 | 0.025 |

| Digital technologies | Frequency | Degree centrality | Betweenness centrality |

|---|---|---|---|

| AI | 0.037 | 0.119 | 0.006 |

| Blockchain | 0.147 | 0.343 | 0.129 |

| Internet of things | 0.003 | 0.029 | 0.0 |

| Machine learning | 0.028 | 0.134 | 0.009 |

| Digital technologies | Frequency | Degree centrality | Betweenness centrality |

|---|---|---|---|

| AI | 0.077 | 0.242 | 0.055 |

| Augmented reality | 0.002 | 0.012 | 0.0 |

| Blockchain | 0.027 | 0.151 | 0.045 |

| Cloud computing | 0.005 | 0.078 | 0.003 |

| Internet of things | 0.013 | 0.163 | 0.036 |

| Machine learning | 0.052 | 0.272 | 0.091 |

| Virtual reality | 0.005 | 0.042 | 0.001 |

| Digital technologies | Frequency | Degree centrality | Betweenness centrality |

|---|---|---|---|

| AI | 0.061 | 0.171 | 0.037 |

| Augmented reality | 0.014 | 0.083 | 0.006 |

| Cloud computing | 0.002 | 0.008 | 0.0 |

| Internet of things | 0.038 | 0.191 | 0.038 |

| Machine learning | 0.045 | 0.145 | 0.022 |

| Virtual reality | 0.014 | 0.083 | 0.008 |

| 3D printing | 0.078 | 0.216 | 0.063 |

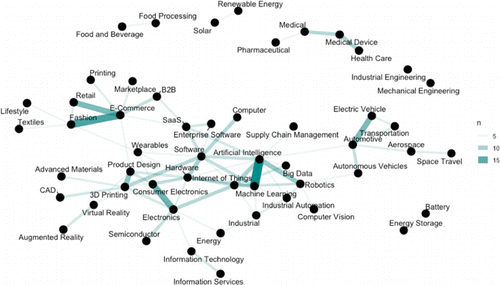

Betweenness centrality refers to how important a node is as a link between two or more network segments [Bengfort et al. (2018); Zinoviev (2018)]. In other words, it measures the number of times a node is included in the shortest paths which interconnect other nodes. In our case, we use betweenness centrality to examine whether digital technologies are used as bridges or boundary spanners to connect different subsectors. Betweenness centrality is calculated as the number of shortest paths that include a specific node divided by the total number of shortest paths [Zinoviev (2018)]. To visualize the co-occurrence networks of the selected industries and illustrate relationships between sector and digital technology keywords, we use the igraph package of R program [Silge and Robinson (2019)]; the thicker line between two keywords indicates a stronger link between them (see Figs. 1–4). Figures 1–4 indicate links between the keywords that co-occur together five or more times in a startup category description. Those keywords that co-occur less than five times are not included in the network graphs in order not to overload the graphs with too many nodes/edges and to clearly visualize the links between keywords that co-occur most frequently. Tables A.1–A.5 present only those digital technologies and their links with business areas/subsectors that co-occur two or more times.

Fig. 1. Social network analysis of the strong and weak connections between sector and digital technology keywords in the Education sector.

Fig. 2. Social network analysis of the strong and weak connections between sector and digital technology keywords in the Finance sector.

Fig. 3. Social network analysis of the strong and weak connections between sector and digital technology keywords in the healthcare sector.

Fig. 4. Social network analysis of the strong and weak connections between sector and digital technology keywords in the manufacturing sector.

4. Results

The results obtained from the co-word analysis show digitalization trends across industries and the links between digital technologies and subsectors (see Tables A.1–A.5). Specifically, looking first at the education sector, startup companies focus on bringing AI, augmented reality, blockchain, machine learning and virtual reality technologies in training and e-learning domains (see Table A.1). These digital technologies allow to considerably change the teaching and learning process. First of all, AI and machine learning give possibilities to personalize the teaching and learning process by studying students’ individual capabilities and evaluating the quality of curriculum and content based on advanced data analytics. Given that students have different types of learning capabilities, AI machines can play an important role for enhancing learning through computing complex machine learning algorithms to analyze and understand each student’s strengths, skills and interests and to deliver teaching material in a flexible and learner-centric way that is most appropriate to them [Luckin et al. (2016); Leahy et al. (2019)]. Another use of AI and machine learning is in language learning (see Table A.1). These technologies equip language learning apps by language recognition tools that are capable to recognize written and spoken contributions and also provide a possibility to interact with the AI bot and learn a foreign language through the process of communication with a virtual tutor. In the process of developing personalized and online education systems, blockchain technology plays also an important role. It is a distributed ledger technology and allows a transparent and secure means of data transaction [Tschorsch and Scheuermann (2016); Chen et al. (2018)], which provides a possibility to equip online learning platforms with learning materials and libraries and, as a result, to develop online courses.

Another emerging trend in the education industry is gamification. As the data analysis shows, augmented realitya and virtual reality technology keywords co-occur together with training and e-learning as well as with video games/gamification, museums/historical sites and aerospace (see Table A.1). Both these digital technologies transform the education system by enhancing game-based learning and making learning complex subjects more exciting and engaging for students [Pellas et al. (2019); Leahy et al. (2019)], as well as increasing efficiency and reducing costs of training in different industries. In other words, augmented and virtual reality allow creating a virtual environment in which students can interact with objects similar to those in the real world, for example, to explore museums and historical sites without leaving a class. Furthermore, as Table A.1 indicates, the aerospace sector incorporates augmented reality and virtual reality technologies in education programs to provide safer and more effective training and flying experience with low costs. Another education application of augmented reality is in e-books (see Table A.1). Augmented reality e-book is “a physical book which contains images that when scanned by a device camera and recognized by the augmented reality application triggers the display of augmented resources including images, video clips and 3D models as overlays onto the screen.” [Leahy et al. (2019, p. 4)].

In the finance industry, the major digital technologies that are mentioned in the categories of startup business description are AI, blockchain, and machine learning. These technologies are used in transforming the entire value chain in the financial sector and digitalizing services such as payments, insurance, lending and asset management as well as venture capital, stock exchange and consulting (see Tables A.2 and A.3). AI and machine learning technologies enable companies to analyze the huge volume of structured and unstructured data in real time and to provide automated and personalized financial services to their customers. Using machine learning algorithms, AI can draw data-driven insights and compute the best investment opportunities, identify fraudulent transactions and enhance security, accurately assess financial risks and loan eligibility as well as make precise predictions for trading and asset/wealth management [Kaya (2019)]. Blockchain also plays a key role in automating and personalizing financial services. Initially, blockchain technology was invented for transactions of cryptocurrenciesb [Nakamoto (2008)], but the technology shows features that are applicable for other financial services such as crowdfunding, payments, loans and credit systems [Swan (2015); Gomber et al. (2017)]. It is a decentralized and distributed system that enables entities to remove a third party such as a bank in financial exchange and provides transparent and secure means of financial operations for payments, loans, stock and asset exchange at low costs.

Looking at the healthcare industry, digital technologies (i.e. AI, blockchain, and machine learning) are employed to transform health diagnostics and to develop mobile apps for personal health (see Table A.4). Mobile health apps enable patients and healthcare organizations to monitor certain severe diseases (e.g. diabetes, depression) to determine the likelihood of any kind of emergencies and to generate health-related data [Bhavnani et al. (2016)]. Moreover, AI and blockchain technologies are used in electronic health records and genetics (see Table A.4). An electronic health record (EHR) refers to a patient medical history that is systematically collected as a part of the diagnostic process in a digital format, and it makes individual medical records (e.g. diagnoses, treatment plans, test results) available for immediate analysis [Mitchell and Kan (2019)]. Blockchain plays a key role in developing an electronic health record system as the technology allows healthcare organizations to protect patients’ data from all types of security threats at low costs [Mackey et al. (2019)].

Furthermore, AI and machine learning are associated with elder care and clinical trials (see Table A.4). The increased level of the elderly population puts pressure on the healthcare sector across the globe to connect elderly patients with caregivers and provide home medical care. Table A.4 also shows that augmented reality co-occurs together with medical device keywords in the category description of healthcare startup businesses. Augmented reality-based medical devices give possibilities to see patient anatomy in a 3D model, which helps physicians in complex surgical planning and diagnostics.

In all of the above presented industries, the internet of things technology has very low frequency and centrality values (see Tables 2–4) and does not show more than one co-occurrence with education, finance and healthcare subsector keywords, suggesting that the technology is at the early stage of adoption in the mentioned sectors. Similarly, cloud computing has very low frequency and centrality values in the healthcare and manufacturing sectors.

In contrast to education, finance and healthcare sectors, the internet of things technology is at the center of manufacturing industry digital transformation, and it is used in the wide set of manufacturing areas such as product design, supply chain management and wearable technologies as well as drones, smart homes, construction manufacturing and autonomous vehicles (see Table A.5); the technology has high degree centrality value in the network of manufacturing sector keywords (see Table 5). Moreover, Table A.5 shows that AI systems and machine learning algorithms are used in supply chain management and in autonomous vehicles. 3D printing technology is also increasingly employed in the manufacturing industry. It has high degree centrality value in the network of manufacturing sector keywords (see Table 5), and it is related to product design, wearable technologies and fashion/textile manufacturing areas (see Table A.5). The technology allows to print physical objects in 3D format, and in this way, it enables to substantially diminish the time and costs of manufacturing processes and give possibilities to use resources more effectively and efficiently [Alcácer and Cruz-Machado (2019)]. Finally, looking at augmented reality and virtual reality, both these digital technologies are related to product design (see Table A.5). The former is also associated with wearable technologies, whereas the latter is related to the construction manufacturing area. The augmented reality and virtual reality technologies have important applications in product design. Specifically, they allow designers and engineers to digitally visualize product and production process and to study them and to detect design errors in a virtual environment.

5. Conclusion and Implications

This research uses text mining and social network analysis methods to provide a framework for mapping industry digital trends and to study the nature and characteristics of this process across different sectors. The results obtained from the analyses indicate that gamification and personalization are emerging trends in the education industry. In the finance sector, digital technologies transform the entire value chain and digitalize services such as payments, insurance, lending, and asset management as well as venture capital, stock exchange and consulting. In the healthcare industry, startup companies focus on digitalizing and automating health diagnostics and developing remote or home healthcare services. In the manufacturing sector, digital technologies are used in automating industrial processes and creating smart interconnected manufacturing as well as digitalizing product design areas in order to diminish the time and costs of manufacturing processes and to use resources more effectively and efficiently.

The research has a number of implications. First of all, we measure the specialization and competencies of digital startup firms across different sectors. The Standard Industrial Classification (SIC) system fails to precisely capture different business activities and classifies them as “Others” in SIC taxonomy [Marra et al. (2015); Papagiannidis et al. (2018); Losurdo et al. (2019)]. This is especially true for digital firms which are more dynamic, innovative and technology driven, and the SIC classification system faces limitations to accurately reflect the specialization and competencies of digital companies. This, in turn, limits policy-makers to design and implement more targeted economic and innovation policy as they face lack of evidence about significant part of digital businesses. Using CrunchBase metadata, the paper provides detailed analysis of technology competencies presented in digital startup companies across different sectors and measures in which business area firms bring digital technologies.

The paper also provides evidence that startup data analysis can be an important source for detecting business and technology trends. The literature of technology foresight mainly focuses on the analysis of patents and scientific publications for identify emerging technologies and for gathering information about weak signals of technological changes and for detecting market threats and opportunities [Choi et al. (2012); Kim et al. (2016); Guo et al. (2016)]. In contrast to the existing literature, we study startup entrepreneurial activities and explore where new entrants find market opportunities across different sectors. The results demonstrate the usefulness of text mining and network analysis approach to identify trends and patterns in startup entrepreneurial activities and to scan market environment as well as to detect industry digitalization trends and to map emerging business areas. In particular, the study shows that the co-word analysis can help companies to obtain meaningful insights about industry landscape and to study in which areas digital technologies are transforming businesses in order to make better decisions for strategic planning and investment policy.

Furthermore, we provide a methodological approach to identify which digital technologies reshape various industries and also to explore the degree of industry digital transformation levels. For this purpose, the network degree centrality has been calculated for digital technologies presented in products and services of startup companies across education, finance, healthcare and manufacturing sectors. Those digital technologies with high degree network centrality values show that they are in direct contact with many business areas, and this indicates the level of their usage and adoption in specific sectors. For instance, the results show that AI, blockchain and machine learning are major technologies that are used in the digital transformation of finance sector, whereas the internet of things is in the early stage of adoption. Similarly, the internet of things has also very low frequency and centrality values in education, finance and healthcare sectors, suggesting that the technology is at the early stage of adoption in the mentioned industries. In contrast, the internet of things technology is at the center of manufacturing industry digital transformation, and it is used in the wide set of manufacturing areas. Studying the degree centrality of digital technologies and their linkages with business areas in different sectors can serve as viable metrics and tools that can provide policymakers and established companies with detailed information about new markets, products, and technologies as well as can help them to detect potential digital market threats and opportunities.

The analysis presented in the research can be replicated on a regional level to study specialization and digitalization trends across territories. The research can be also extended to a time series startup database in order to study future links between digital technologies and business areas by applied dynamic social network analysis and to examine different scenarios of digital transformation processes across industries.

Acknowledgments

The project leading to this application has received funding from the European Union’s Horizon 2020 research and innovation programme under the Marie Sklodowska-Curie Grant Agreement No. 832862. Dr. Jari Kaivo-oja notes that this study is directly linked to the project “Platforms of Big Data Foresight (PLATBIDAFO)”, which has received funding from European Regional Development Fund (project No 01.2.2-LMT-K-718-02-0019) under grant agreement with the Research Council of Lithuania (LMTLT). This study is partly linked to the Manufacturing 4.0 project of the Strategic Council of the Academy of Finland.

Notes

a Augmented reality is a technology that allows the integration of virtual objects into the real world. “In contrast to virtual reality, in which the user is completely immersed in a virtual world and has no perception of the real world, augmented reality uses the real world as its source and overlays virtual objects so the real and virtual appear as one to the user” [Leahy et al. (2019)].

b Digital currencies.

Appendix

| Training | E-learning | Language learning | Mobile apps | E-books | Video games/gamification | Museums and historical sites | Aerospace | |

|---|---|---|---|---|---|---|---|---|

| Artificial intelligence | X | X | X | X | ||||

| Augmented reality | X | X | X | X | X | X | X | |

| Blockchain | X | X | ||||||

| Machine learning | X | X | X | |||||

| Virtual reality | X | X | X | X | X | X |

| Cryptocurrency | Payments | Personal finance | Insurance | Asset/wealth management | Security | Credit/lending | |

|---|---|---|---|---|---|---|---|

| Artificial intelligence | X | X | X | X | X | X | X |

| Blockchain | X | X | X | X | X | X | X |

| Machine learning | X | X | X | X | X | X | X |

| Venture capital | Risk management | Stock exchanges/trading platform | Financial exchanges | Compliance/consulting/information services | Crowdfunding | |

|---|---|---|---|---|---|---|

| Artificial intelligence | X | X | X | X | X | |

| Blockchain | X | X | X | X | X | |

| Machine learning | X | X | X | X | X |

| Health diagnostics | Personal health | Mobile health (mHealth) | Elder care | Clinical trials | Medical device | Electronic health record | Genetics | |

|---|---|---|---|---|---|---|---|---|

| Artificial intelligence | X | X | X | X | X | X | ||

| Augmented reality | X | |||||||

| Blockchain | X | X | X | X | X | |||

| Machine learning | X | X | X | X | X | X |

| Autonomous vehicles/transportation | Product design | Wearables | Construction | Drones | Energy efficiency/renewable energy | Supply chain management/logistic | Optical communication | Fashion/textile | Smart home | |

|---|---|---|---|---|---|---|---|---|---|---|

| Artificial intelligence | X | X | X | X | X | X | X | X | ||

| Augmented reality | X | X | ||||||||

| Internet of things | X | X | X | X | X | X | X | X | X | |

| Machine learning | X | X | X | X | ||||||

| Virtual reality | X | X | ||||||||

| 3D printing | X | X | X |

Levan Bzhalava is a Marie Curie postdoctoral fellow at Finland Futures Research Centre, University of Turku in Finland. He is also a visiting lecturer and data scientist at Kazimieras Simonavicius University in Lithuania. Moreover, Levan was a senior researcher at Caucasus University in Georgia and a research fellow at Mälardalen University in Sweden. He received the Ph.D. Economics degree from the Max Planck Institute of Economics and Friedrich Schiller University Jena in Germany (in 2015).

Sohaib S. Hassan works as a senior postdoc in the Faculty III: School of Economic Disciplines at the University of Siegen, Germany. At the faculty, he is a member of the graduate research group (KontiKat) of the Federal Ministry of Education and Research, Germany (BMBF). Since, 2016, he is the research coordinator of the SME Graduate School of the faculty. He received the B.A. and M.Sc. Economics degrees from the University of the Punjab, Pakistan, and the M.B.A. degree from the University of Leipzig, Germany. He received the Ph.D. Economics degree from the Max Planck Institute of Economics and Friedrich Schiller University Jena, Germany in 2014.

Jari Kaivo-oja is the Research Director at the Finland Futures Research Centre of the Turku School of Economics as well as an Adjunct Professor at the University of Helsinki and at the University of Lapland. He has worked for the European Commission (FT6, FP7, H2020), the European Foundation, the Nordic Innovation Center (NIC), Eurostat, NATO, the Finnish Funding Agency for Technology and Innovation (TEKES), RAND Europe, and for the European Parliament. Currently, he is a researcher at European Research Infrastructures in the International Landscape (Horizon 2020), at Radical Innovation Breakthrough Inquirer (European Commission), at European Futures for Energy Efficiency (Horizon 2020) and at Transition to a Resource Efficient and Climate Neutral Electricity System (Academy of Finland). He is also the principal investigator of the Academy of Finland in “Manufacturing 4.0” project. In 2016 he worked as Scientific Evaluator at European Academy of Management (Paris, France), at the Marie Sklodowska-Curie actions of the EU Horizon 2020 programme (Brussels, Belgium) and at the National Science Center of Poland. Prof. Kaivo-oja is international expert in the field of foresight and innovation studies.

Bengt Köping Olsson is a lector and researcher in innovation management at Mälardalen University in Sweden. He has the background of an engineer and a degree in psychology. He has a Master of Fine Arts in piano and has been teaching piano and also worked as a musician on a freelance basis. Köping Olsson’s research focus is on collective thought processes and factors that enable group creativity - how group members consider each other’s initiatives to achieve shared goals.

Javed Imran is an associate professor at the Entrepreneurship and Innovation Centre, Kazimieras Simonavicius University in Lithuania. He was also a visiting lecturer at the University of Information Technology and Management in Rzeszow, Poland. He received Ph.D. in environment and resource management from Northwest A&F University China (in 2012). His current research focuses on large-group techniques to increase cross-organizational innovation as well as other communication mechanisms to deal with the complex, multi-stakeholder problems of integrating corporate responsibility and sustainability.