THE IMPACT OF EU TAXONOMY ON CORPORATE INVESTMENTS

Abstract

The European Union Taxonomy on Sustainable Finance is the first comprehensive classification designed to identify the extent to which an economic activity is environmentally sustainable. This paper investigates how the EU Taxonomy affected corporate investments for Taxonomy-eligible companies compared to non-eligible ones. We applied a difference-in-difference model using a dataset of 130,918 firms from 27 EU Member States, using 2019 as a threshold. Our findings show that the introduction of the EU Taxonomy per se did not result in an increase in corporate investments among Taxonomy-eligible companies; rather, firms’ size and Taxonomy-eligibility uncertainty played a key role in explaining variation in corporate investments. The implications are twofold: the participatory and communication approach of the European Commission implemented with the EU Taxonomy is effective in nudging corporate investments aimed at sustainability. However, this only happens when the regulation provides an unambiguous sector specification. Thus, it is important that the regulatory interventions clearly define what is sustainable.

1. Introduction

By adopting the Paris Climate Agreement in 2015, the European Union (EU) committed to building its Member States’ resilience to climate change and limiting global warming to well below 2∘C. Since current levels of corporate investments are not sufficient to achieve EU climate and energy targets by 2030, the financial sector may contribute to mobilizing large amounts of private capital to reach these goals. The absence of commonly agreed-upon principles and metrics for assessing whether economic activities are environmentally sustainable has been a major obstacle to redirecting capital flows towards more sustainable economic activities. At the same time, there is growing evidence of investors’ interests for investing in sustainable asset classes, even among institutional investors (Riedl & Smeets 2017, Krueger et al.2020). To overcome this barrier and mitigate the phenomenon of greenwashing, in the last years the European Commission has devoted significant efforts which leads to several policy initiatives, like the development of the EU Green Bond Standard and the Sustainability Benchmarks. Among the sustainable finance policies, the most important one was the publication of the EU Taxonomy on Sustainable Finance in 2019, a classification system for sustainable activities.

Disruptive by nature, the Taxonomy joins the consolidation and indirect approaches to regulation. On the one hand, the EU Taxonomy consolidates existing sector-specific environmental regulations, introducing strict technical criteria to establish the extent to which companies’ activities are environmentally sustainable. On the other hand, the EU Taxonomy follows an indirect approach that introduces sustainability-linked transparency requirements for financial market participants that offer sustainable financial products. In other words, “finance” (the supply side of capital markets) can be claimed “sustainable” only if capital flows are directed towards companies (demand side) that align with sector-specific environmental regulations set forth in the EU Taxonomy. In this way, the EU Taxonomy is expected to put pressure on companies to pursue corporate investment strategies aimed at improving their sustainability profile to avoid missing out on funding opportunities. This paper investigates whether Taxonomy regulation (TR) has started to produce the expected effects on corporate investment. To this aim, we rely on a wide sample of European balance sheets, comprising micro, small, medium and large companies. Given that EU Taxonomy advocates environmental-related investments, the variation of intangible fixed assets (Bigelli et al. 2014) would be a good proxy to compensate for the lack of specific data on environmental investments for the companies in our sample. Unfortunately, most of the firms in our sample do not disclose information on intangible fixed assets; we therefore define investment variables based on tangible fixed assets (as in Guariglia 2008, Akbar et al. 2013, Badertscher et al. 2013).

Variations in companies’ fixed assets will therefore be assumed as a reaction in terms of firms’ investment policy to the dictates of EU Taxonomy. According to some previous literature (Li et al. 2022), when the operating environment undergoes major changes in developing a low-carbon economy, firms need to make trade-offs between short-term benefits and long-term development building appropriate investment horizon choices. More specifically, depending on the uncertainty hovering over the operating environment, firms might be allured by short-term benefits and be insufficiently willing to invest in irreversible R&D and fixed assets (Baum et al. 2006, Bloom et al. 2007, Nakano & Nguyen 2012).

To obtain a precise estimate of the Taxonomy impact on investment variation we apply a difference-in-difference model that compares firms operating in Taxonomy-eligible economic activities (treated group) and firms operating in other sectors (control group). Indeed, the development of the EU Taxonomy relies on a sectorial framework: the NACEa industrial classification system has been adopted to identify Taxonomy-eligible economic activities and sector-specific technical criteria. Nevertheless, the EU Taxonomy does not yet create an exhaustive list of environmentally sustainable economic activities, as it follows a progressive approach; this means that eligible sectors are gradually added and identified with different levels of NACE precision over time. Furthermore, since the Taxonomy-eligible activities are identified with different NACE-digit levels of detail, we argue that firms operating in various sectors do not face the same degree of uncertainty thus creating some “Taxonomy-eligibility” uncertainty for corporate investment strategies (Bernanke 1983, Pindyck 1991, Dixit & Pindyck 1994).

Therefore, we study companies’ response to the EU Taxonomy in terms of investment variation before and after 2019, considering the different level of precision with which the eligible sectors are deemed. Truth be told, the EU Taxonomy was issued in mid-2019 and the first delegated act (which defined technical screening criteria for climate change adaptation and mitigation objectives) was published in the Official Journal of the European Union on 9 December 2021 and was applicable since January 2022b; what we here hypothesize is that Taxonomy-eligible companies made early preparations for the upcoming Taxonomy and following technical criteria even before the acts were issued, when there was a reasonable certainty they would eventually be adopted.

Our results show that the introduction of the EU Taxonomy did not lead to increased investment per se for firms belonging to eligible sectors. Rather, we confirm that Taxonomy-eligibility uncertainty is a driving force: When sectors are identified with a sufficient level of precision (i.e. the Taxonomy-eligibility uncertainty is lower) firms increase their corporate investments compared to non-eligible ones. When it comes to corporate size, medium and large companies tend to increase their investment more than small companies dealing with the same level of Taxonomy-eligibility uncertainty. Importantly, we include in all specifications sector fixed effects to ensure that the documented variation in investments are not due sector characteristics. Furthermore, our results are robust to including both sector and country variables that may drive differential investment patterns. Also, by re-estimating the model after a matching strategy to create a control group that is as similar as possible to the treated group, confirms our evidence.

Our paper contributes to the literature in different ways. The creation of the EU Taxonomy was made possible thanks to an ongoing engagement process based on dynamic interactions with involved stakeholders, on both the offer and demand side of capital markets. While previous scholars have studied the adoption of sustainable and environmental practices, referring to reactive and proactive strategies (Baah et al.2021, Wang et al. 2020), we here contribute to the debate on how sectorial uncertainty (Taxonomy-eligibility) relate to corporate investments. Furthermore, given that corporate responses to Taxonomy-eligibility uncertainty may be affected by the firm’s size (Bo 2001, Campa 1994, Ghosal & Loungani 2000), we investigate whether micro/small firms differently react compared to medium/large-sized firms. We therefore relate Taxonomy-eligibility uncertainty with the corporate dimension, expanding the limited empirical evidence on uncertainty provided by Koetse et al. (2006).

Our paper has also practical implications in that it offers a detailed overview of the EU Taxonomy, it explores companies’ reactions to this new regulation, and it investigates the extent to which the EU Taxonomy has operated as an incentive (or “nudge”) to corporate investments providing preliminary insights on the impact of the EU Taxonomy.

In the following section, we provide a detailed description of the EU Taxonomy framework. Section 3 illustrates some previous literature on which our hypotheses are grounded. Section 4 provides a descriptive summary of our data set and presents the econometric approach. We then provide our empirical evidence in Sec. 5 and discuss the study’s implications in the final section.

2. The EU Taxonomy Roadmap: Timeline and Engagement of Stakeholders

The path leading to the initial publication of the EU Taxonomy dates back in 2016, when the European Commission mandated the high-level expert group (HLEG) on sustainable finance to set up recommendations for a sustainable finance strategy for the EU. The report was finally published on 31 January 2018. Two months later, building upon the HLEG’s vision, the EU Commission published the “Action Plan on sustainable finance” (COM(2018)97), which established the actions needed to connect finance with efforts to meet long-term climate and energy targets. This Action Plan places the highest emphasis on the need to develop a shared understanding of what “sustainable” means as a pre-condition to channeling capital flows towards more sustainable economic activities. Therefore, the European Commission further mandated the technical expert group (TEG) on sustainable finance to develop a unique classification within the EU — the so-called EU Taxonomy — that would define the extent to which a company’s activities are sustainable.

In detail, the EU Taxonomy comprises a list of economic activities with performance criteria, whose achievement contributes to six environmental objectives: (i) climate change mitigation, (ii) climate change adaptation, (iii) sustainable use and protection of water and marine resources, (iv) transition to a circular economy, (v) pollution prevention and control, and (vi) protection and restoration of biodiversity and ecosystems. To be included in the EU Taxonomy, an economic activity must: (i) contribute significantly to at least one of the environmental objectives (respecting specific technical criteria, metrics and thresholds); (ii) not significantly harm the other objectives (do no significant harm (DNSH)); and (iii) comply with the “minimum social standards”. Based on the NACE classification (the official industry classification used in the EU), the TEG selected a list of macro-economic sectors that are considered relevant in terms of GHG emissions while covering a significant proportion of GDP and total employment of the EU-28. For each macro-sector, the TEG identified a list of eligible activities. Indeed, an economic activity that fulfils the conditions (i), (ii), (iii) and complies with the technical screening criteriac can be recognized as Taxonomy-aligned.

Currently, the Taxonomy only considers sectors with the highest contribution to CO2 emissions (energy, manufacturing, transport, buildings), as well as activities enabling their transformation. Since the EU Taxonomy will be developed gradually over time, other economic activities from different sectors and sub-sectors will likely be included soon. Furthermore, the Final Report on the EU Taxonomy, published by the European Commission in March 2020, focuses solely on the first two environmental objectives: namely, climate change mitigation and adaptation. Of course, developing such a classification system is an ambitious undertaking due to its complexity and highly technical nature. Thus, the Commission proposed a step-wise and progressive approach that could respond to the evolving EU policy objectives, data and technologies. Consequently, it would take time to arrive at a fully-fledged EU Taxonomy for sustainable activities, covering also the remaining environmental objectives or social activities.

We present a summary of the main events and/or documents that marked the process of establishing the EU Taxonomy in Table B.1 in the appendix. We have highlighted the stages of interaction with stakeholders in italics. As a matter of fact, the EU Taxonomy represents not only a new regulatory framework, but also a continuous interaction among different players. Indeed, during the entire phase of drafting the EU Taxonomy, the TEG opened different calls for feedback and invited a wide range of stakeholders to give input on the report.

On 12 July 2020, the TR for climate change mitigation and adaptation (Regulation (EU) 2020/852), which embeds the EU Taxonomy into law, entered into force.d Besides defining the technical screening criteria, the TR outlines new legal obligations for three specific groups of EU Taxonomy users: financial market participants, large companies, and the EU and Member States.e

In practice, large financial and non-financial companiesf must disclose the corresponding percentage of their performance (turnover, capital expenditure, or operational expenditure) that meets the criteria set out in the EU Taxonomy. This, in turn, creates a need for financial market participants investing in that company to compute and disclose its proportional share of Taxonomy-aligned investment. Infringements of the transparency provisions in articles 5, 6 and 7 of TR can entail penalties.

In terms of implementation aspects, the TR (Regulation (EU) 2020/852), empowers the Commission to adopt delegated and implementing acts to specify how competent authorities and market participants shall comply with the obligations laid down in the directive. In other words, the TR tasks the Commission with establishing the actual list of environmentally sustainable activities by defining technical screening criteria for each environmental objective through delegated acts.g On 9 December 2021, a first delegated act on sustainable activities for climate change mitigation and adaptation objectives of the EU Taxonomy (“Climate Delegated Act”) was published in the Official Journal. The delegated act was applicable from 1 January 2022. More recently, on 9 March 2022, the Commission adopted a Complementary Climate Delegated Act including, under strict conditions, specific nuclear and gas energy activities in the list of economic activities covered by the EU taxonomy. It was published in the Official Journal on 15 July 2022 and was applied since January 2023.

3. Literature Review and Hypotheses

Over the past two decades, a large literature has arisen around environmental regulation (recall the debate since Eiadat et al. (2008), Frondel et al. (2007), Jaffe et al. (1995), Porter (1991) and Porter & Van der Linde (1995)) and its effects on corporate investment strategies (Doh & Pearce 2004, Hoffmann et al. 2008, 2009). Nevertheless, the EU Taxonomy falls outside the scope of traditional environmental regulation. The EU Taxonomy is the first international attempt to define sector-specific technical criteria that establish whether a company’s activities can be considered green for financial purposes.

The growing research area of sustainable finance confronted with the issue of identifying green or sustainable companies. A market-based solution has been the ESG ratings, environmental, social and governance scores that provide a measure of a company’s relative performance along these three sustainability dimensions. While ESG ratings are a screening tool used by investors (Ciciretti et al. 2019, Demers et al. 2021), they may differ quite substantially from data providers and suffer from important measurement issues (Berg et al. 2019, Capizzi et al. 2021). Alternatively, new market segments have been established for financial products with “green” labels, such as green bonds and green loans. Recent papers provided empirical evidence on the benefits of accessing the green market, both for corporate (Flammer 2021, Tang & Zhang 2020) and sovereign issuers (Dell’Atti et al. 2022). While green bond issuances have grown rapidly over the past decade, the green loan market is still at its infancy, but green classification standards — which defines what projects are available for green credit — are already available.

Differently from ESG ratings or ad hoc labels, the EU Taxonomy provides the basis for using such a classification in different areas (e.g. standards, labels and sustainability benchmarks). In addition, it is a general and harmonized framework that applies to companies, market participants, and financial products. The key issue is how regulatory interventions can stimulate cleaner investments and incentivize firms to adopt activities that are less environmentally harmful without incurring excessive costs (Frondel et al. 2007).

Given the indirect approach of the EU Taxonomy, the TR imposes obligations on the financial sector (Reg 852/2020) regarding what can be labeled as sustainable, which should foster (financial) stakeholder pressure that incentivize companies to pursue corporate investment strategies aimed at sustainability. Consequently, the concern over losing funding opportunities from the financial sector should lead companies (that are included by NACE in the 2019 Technical Report) to react by significantly increasing their investments even before both the EU Taxonomy and the detailed technical criteria (delegated acts) were into force, to make early preparations for upcoming requirements. This leads to the first hypothesis of this paper:

| HP1: | Companies belonging to NACE sectors mentioned in the TEG 2019 Technical Report will show an increase in their investments, differently from those belonging to non-eligible sectors. | ||||

Since the EU Taxonomy relies on a sectorial framework with a dynamic pattern in terms of NACE digits, which are added with a progressive specificity, there is a problem of uncertainty for corporate investment strategies (Bernanke 1983, Pindyck 1991, Dixit & Pindyck 2012). Indeed, the TEG has identified the list of taxonomy-eligible activities some at a very detailed level with the NACE 4 digits, and others at a less precise 2 and 3-digit level. This fosters uncertainty over Taxonomy-eligibility for firms, which can be framed in terms of contingency theory (Emery & Trist 1965, Lawrence & Lorsch 1967, Tosi et al. 1973). Since investment decisions are irreversible in most cases, firms might postpone actions until more information becomes available (Dixit & Pindyck 1994). The previous theoretical literature provides mixed predictions on the effect of investments under uncertainty, with some authors supporting a positive effect on investments (Abel 1983, Caballero 1991, Hartman 1972) and others predicting a negative one (Pindyck 1993, Dixit & Pindyck 1994). Notably, most empirical studies find a negative relationship (Leahy & Whited 1995, Guiso & Paris, 1999). Consequently, we further question if firms differently vary their investments based on the level of Taxonomy-eligibility uncertainty they face (NACE digits precision). Accordingly, we derive the second hypothesis of the paper:

| HP2.1: | A lower level of Taxonomy-eligibility uncertainty leads to an increase in corporate investments. | ||||

In addition, previous studies have shown that firms can react differently to uncertainty depending on their size (Campa 1994, Bo 2001, Ghosal & Loungani 2000). Indeed, large firms are more likely to have access to more and better information than small firms, and thus may have the opportunity to hedge against risk and uncertainty. Likewise, greater uncertainty exacerbates information asymmetries between borrowers and lenders (Greenwald & Stiglitz 1990). Small firms have higher information opacity, adverse selection, and costly verification (Diamond 1991, Berger & Udell 1998, Benmelech & Bergman 2009), as well as face higher hurdles to providing collateral (Gertler & Gilchrist 1994, Fazzari et al. 1988). These aspects can give large firms an edge in addressing or even reducing Taxonomy-eligibility uncertainty, which may be reflected in their investment patterns. Therefore, we tested this final hypothesis:

| HP2.2: | Given the same level of Taxonomy-eligibility uncertainty, medium and large companies tend to react to that uncertainty by increasing their investment more than micro and small companies. | ||||

4. Data and Empirical Model

4.1. Data and sample

Our first data source is the list of Taxonomy-eligible sectors based on the NACE code, as identified in the 2019 Taxonomy Technical Report. NACE uses four levels: Level 1, consisting of headings indicated by the letters A to U, is the first layer of sectors (named sections). Level 2, indicated by 2-digit codes from 01 to 99, is the second layer of sectors (divisions). Level 3, indicated by 3-digit codes from 01.1 to 99.0, is the third layer of sectors (groups). Level 4, indicated by 4-digit codes from 01.11 to 99.00, is the fourth layer of sectors (classes). The “macro” sectors (sections) considered by the TEG are: Agriculture, forestry and fishing (A), Manufacturing (C), Electricity, gas, steam and air conditioning supply (D), Water Supply; Sewerage; Waste Management and Remediation activities (E), Construction (F), Real estate activities (L), Transporting and storage (H), and Information and communication (J).h Within each section, the TEG identifies a list of activities that are Taxonomy eligible at the level of NACE 4 digits, for utmost precision, or at a less precise digit level, that is NACE 3 digits and NACE 2 digits. Table 1 shows an example for the construction industry on how some sectors were defined at the level of NACE 2 digits while others at the level of NACE 4 digits.

| NACE 2 digits | NACE 3 digits | NACE 4 digits | Description | Taxonomy | TAXONOMY_A | TAXONOMY_B |

|---|---|---|---|---|---|---|

| 41 | Construction of buildings | Yes | ||||

| 41.1 | Development of building projects | |||||

| 41.10 | Development of building projects | 1 | 2 | |||

| 41.2 | Construction of residential and non-residential buildings | |||||

| 41.20 | Construction of residential and non-residential buildings | 1 | 2 | |||

| 42 | Civil engineering | |||||

| 42.1 | Construction of roads and railways | |||||

| 42.11 | Construction of roads and motorways | Yes | 1 | 1 | ||

| 42.12 | Construction of railways and underground railways | Yes | 1 | 1 | ||

| 42.13 | Construction of bridges and tunnels | Yes | 1 | 1 | ||

| 42.2 | Construction of utility projects | |||||

| 42.21 | Construction of utility projects for fluids | 0 | 0 | |||

| 42.22 | Construction of utility projects for electricity and telecom. | 0 | 0 | |||

| 42.8 | Construction of other civil engineering projects | |||||

| 42.91 | Construction of water projects | Yes | 1 | 1 | ||

| 42.99 | Construction of other civil engineering projects n.e.c. | 0 | 0 |

Second, we obtained firm-level data from Amadeus by Bureau van Dijk (BvD a Moody’s Analytics Company). The database includes balance sheets and income statements, as well as information concerning the main sector of activity following the NACE classification (revision 2) at the 4-digit level.i Using Amadeus, we selected active firms located in the Europe Union’s 27 Member States.j We further restricted the sample to the sectors considered by the TEG. We considered the sample period 2015–2019 in order to control for any pre-trend in the years before the EU Taxonomy was introduced and to exclude any possible contamination in the years following the 2019. Note that the COVID-19 crisis and the subsequent government responses had a deep impact on firms’ 2020–2021 balance sheets, with heterogenous effects across sectors and countries; afterwards, war tensions and energy crisis added noise to the understanding of the EU Taxonomy impact on corporate investments. These severe exogenous events make it difficult to isolate the effect of the Taxonomy from 2020 onwards, which is why we limited the sample period to 2019. We excluded firms with incomplete balance sheet information. After all these steps, we were left with 130,918 unique firms.

4.2. Methodology

Our first challenge is modeling corporate investments. Previous works have considered capital expenditures (CapEx), data on mergers and acquisitions, and R&D expenditures. However, Amadeus does not provide this information for a significant share of our sample, including both listed and unlisted firms. Thus, we followed the approach of Badertscher et al. (2013) and proxy investment as the annual variation of fixed assets (a similar approach was also adopted in Asker et al., (2012), An et al. (2016) and De Marco et al. (2021)). Specifically, our variable of interest is defined as the change in fixed assets from year t−1 to t, divided by total assets in year t−1.k Due to the inherent link between the evolution of the value of fixed assets and the underlying firms’ investment decision, i.e. an increase in our variable of interest reflects corporate investment in production and operation (aus dem Moore et al.2019), this analysis allows us to explore the effect, if any, the regulatory pressure that treated firms expect the EU Taxonomy to exert in the long run. Notably, the change in fixed assets has been used in previous literature also to explore changes with carbon regulation on corporate investments (aus dem Moore et al. 2019, Dong et al. 2022). To this end, we implemented a difference-in-difference model (see, among others, Donald & Lang (2007)) using the following econometric specification :

Xisct−1 includes a set of firm control variables that the literature has identified as important determinants of investment (Badertscher et al. 2013). SALES_GR is defined as the percentage change in sales from year t−1 to year t. ROA is equal to profit and losses before taxes, divided by total assets in year t−1. ASSETS is the natural logarithm of total assets in t−1. CASH is cash and cash equivalents divided by total assets in year t−1. LEVERAGE is equal to total liabilities divided by total assets in year t−1. All variables are lagged one period to limit endogeneity issues. The specification is further augmented with country fixed effects δc to account for cross-countries differences, as well as year dummies μt to control for time-varying effects. Finally, ϵisct is the error term, with errors clustered at the company level.

In some specifications, to test Hypothesis 2.1, we consider as treatment the categorical variable TAXONOMY_B taking the value 1 if firm i is in a Taxonomy-eligible sector defined at NACE 4 digits, 2 if firm i is in a Taxonomy-eligible sector defined at NACE 2 or 3 digits, and 0 otherwise (see Table 1).m

4.3. Descriptive statistics and preliminary evidence

Panel A of Table 2 provides the summary statistics for the full sample. Our variable of interest INV is on average equal to 3.10%, with a large variation in the sample. Average sales growth is equal to 18% while ROA is equal to 7%. Companies hold cash for 11% of total assets and are, on average, highly indebted, financing roughly 71% of their assets via debt. Looking at firm sizen in Panel B, the composition of our sample mainly includes medium firms (49%), which are overrepresented with respect to the firm population. Small and large firms account for 29% and 20% of the sample, respectively. Micro-firms represent only a residual category due to their underrepresentation in Amadeus and less stringent disclosure requirements, particularly in some countries (i.e. Germany).

| Panel A: Summary statistics | ||||||

|---|---|---|---|---|---|---|

| N | Mean | P < 50 | St. Dev. | P < 25 | P < 75 | |

| TAXONOMY_A | 353584 | 0.4098 | 0.0000 | 0.4918 | 0.0000 | 1.0000 |

| TAXONOMY_B | 353584 | 0.6742 | 0.0000 | 0.8651 | 0.0000 | 2.0000 |

| INV | 353584 | 3.1095 | 0.1226 | 14.9650 | −1.7255 | 3.7878 |

| SALES_GR | 353584 | 18.8945 | 5.0199 | 75.8492 | −2.4264 | 16.4620 |

| ROA | 353584 | 7.3670 | 4.7743 | 13.5708 | 0.9838 | 11.5926 |

| ASSETS | 353584 | 9.9542 | 9.8532 | 1.4342 | 9.0120 | 10.7873 |

| CASH | 353584 | 11.3258 | 5.0420 | 16.0456 | 1.1331 | 14.8515 |

| LEVERAGE | 353584 | 71.1183 | 65.7099 | 51.4382 | 43.9379 | 86.7670 |

| Panel B: Sample distribution by size category | ||||||

| N | % | |||||

| Micro | 4617 | 1.31 | ||||

| Small | 102580 | 29.01 | ||||

| Medium | 174990 | 49.49 | ||||

| Large | 71397 | 20.19 | ||||

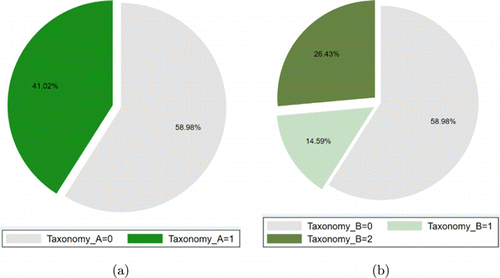

Figure 1 shows treated and untreated firms based on the TAXONOMY_A (Fig. 1(a)) and TAXONOMY_B (Fig. 1(b)) definitions. In our sample, 41% of the observations belong to a sector detailed in the Taxonomy Technical Report, which are split between firms with a NACE 4 digit (14%) and firms with an NACE 2 or 3 digit (26%). The remaining observations (58%) are involved in economic activities that lie outside of the TR.

Fig. 1. Sample distribution of (a) TAXONOMY_A and (b) TAXONOMY_B. (a) shows in green the percentage of taxonomy-eligible firms, independently of the NACE number of digits. (b) shows in light green the percentage of taxonomy-eligible firms at NACE 4 digits, in dark green the percentage of taxonomy eligible firms at NACE 2 and 3 digits. The untreated firms are shown in grey in both graphs.

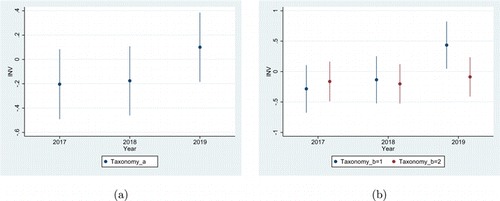

As a starting point for our analysis (see Fig. 2), we plotted the associated coefficients, with their confidence intervals, of the interaction of year dummies with TAXONOMY_A (Fig. 2(a)) and TAXONOMY_B (Fig. 2(b)) of a simple regression explaining INV.

Fig. 2. Preliminary evidence. (a) The coefficients of TAXONOMY_A in each year. (b) The coefficients of TAXONOMY_B, in blue for TAXONOMY_B=1 (NACE 4 digits) and in red for TAXONOMY_B=2 (NACE 2 and 3 digits).

In both graphs, the coefficients of years 2017–2018 were not statistically significant, which suggests that the parallel trend assumption was fulfilled. Importantly, the absence of potential pre-trends in investment substantiated our decision to use difference-in-difference as identification strategy. All coefficients were larger in 2019, which suggests an increase in investment—but only the one for TAXONOMY_B=1 in the right graph was statistically significant. Armed with this evidence, we use the next section to explore the relationship between investment and Taxonomy-eligibility in more detail.

5. Results

5.1. Main results

Table 3 shows the results of Hypothesis 1. In Model 1, based on Eq. (1), the main coefficient of interest — expressed by the interaction between the variables TAXONOMY_A and Post — was positive but not statistically significant. The result was confirmed when we added country×year fixed effect (Model 2) and even sector fixed effects (Model 3), absorbing specificities in particular sectors. Looking at the control variables, we noticed that firms increased their investments if they experienced higher sales growth and profitability, which aligns with the previous literature. ASSET was negatively related to investments, meaning that in our sample smaller firms invest more. While more liquid and leveraged firms have higher level of investments. Thus, we can safely reject Hypothesis 1 and conclude that the introduction of the EU Taxonomy sectors did not increase corporate investment in 2019.

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | INV | INV | INV |

| SALES_GR | 0.0056*** | 0.0056*** | 0.0053*** |

| (0.001) | (0.001) | (0.001) | |

| ROA | 0.0537*** | 0.0538*** | 0.0548*** |

| (0.003) | (0.003) | (0.003) | |

| ASSETS | −0.8540*** | −0.8520*** | −0.9894*** |

| (0.028) | (0.028) | (0.031) | |

| CASH | 0.0114*** | 0.0114*** | 0.0154*** |

| (0.002) | (0.002) | (0.002) | |

| LEVERAGE | 0.0159*** | 0.0160*** | 0.0159*** |

| (0.001) | (0.001) | (0.001) | |

| TAXONOMY_A=1 (4-3-2 digits) | 0.4649*** | 0.4668*** | 0.4402*** |

| (0.068) | (0.068) | (0.141) | |

| TAXONOMY_A=1 (4-3-2 digits)×POST | 0.1670 | 0.1587 | 0.1462 |

| (0.114) | (0.115) | (0.115) | |

| Constant | 9.6409*** | 9.6121*** | 10.9516*** |

| (0.304) | (0.304) | (0.335) | |

| Observations | 353,584 | 353,584 | 353,584 |

| R-squared | 0.0252 | 0.0270 | 0.0310 |

| Year FE | Yes | No | No |

| Country FE | Yes | No | No |

| Year×Country FE | No | Yes | Yes |

| Sector FE | No | No | Yes |

Next, to test Hypothesis 2.1, we replaced the treatment variable with TAXONOMY_B in order to identify Taxonomy-eligible companies based on the level of uncertainty within sector digits. Table 4 shows that the interaction term of TAXONOMY_B=1 and Post was positive and statistically significant at the 1% level. This suggests that companies facing a low level of uncertainty, operating in Taxonomy-eligible sectors defined at the 4-digit level, increase their investment—possibly to improve their sustainability profile. In contrast, the interaction term of TAXONOMY_B=2 and Post was not statistically significant, meaning that the EU Taxonomy does not impact investment when the sectors are identified with an insufficient level of precision.

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | INV | INV | INV |

| SALES_GR | 0.0055*** | 0.0056*** | 0.0053*** |

| (0.001) | (0.001) | (0.001) | |

| ROA | 0.0537*** | 0.0538*** | 0.0548*** |

| (0.003) | (0.003) | (0.003) | |

| ASSETS | −0.8555*** | −0.8535*** | −0.9891*** |

| (0.028) | (0.028) | (0.031) | |

| CASH | 0.0111*** | 0.0112*** | 0.0154*** |

| (0.002) | (0.002) | (0.002) | |

| LEVERAGE | 0.0159*** | 0.0160*** | 0.0159*** |

| (0.001) | (0.001) | (0.001) | |

| TAXONOMY_B=1 (4 digits) | 0.1646* | 0.1682* | 0.3144** |

| (0.096) | (0.096) | (0.157) | |

| TAXONOMY_B=2 (2–3 digits) | 0.6352*** | 0.6375*** | 0.6225** |

| (0.081) | (0.081) | (0.244) | |

| TAXONOMY_B=1 (4 digits)×POST | 0.5329*** | 0.5232*** | 0.5205*** |

| (0.171) | (0.172) | (0.172) | |

| TAXONOMY_B=2 (2–3 digits) × POST | −0.0343 | −0.0469 | −0.0632 |

| (0.133) | (0.134) | (0.134) | |

| Constant | 9.6605*** | 9.6312*** | 10.9185*** |

| (0.304) | (0.304) | (0.337) | |

| Observations | 353,584 | 353,584 | 353,584 |

| R-squared | 0.0252 | 0.0271 | 0.0311 |

| Year FE | Yes | No | No |

| Country FE | Yes | No | No |

| Year× Country FE | No | Yes | Yes |

| Sector FE | No | No | Yes |

This evidence is consistent with the literature suggesting that companies’ uncertainty plays a crucial role in their business decisions and especially in key ones like investment. Indeed, corporate investment decisions are often irreversible and characterized by uncertainty over future payoffs of the initial investment; thus, firms might postpone action until more information becomes available (Dixit & Pindyck1994). Our results are further confirmed by Models 2 and 3, which included a more restrictive set of fixed effects. The positive impact of the Taxonomy on investment variation complements previous results suggesting that firms with higher corporate social responsibility scores increase firm investment efficiency and innovation (Cook et al. 2018, Flammer & Kacperczyk 2016). Thus, while the absence of policy initiatives restricts sustainable investments to the private initiative of a limited number of firms, like the ones involved in CSR topics, our findings suggest that even a non-prescriptive policy initiative may nudge a much larger number of firms towards desirable behavior.

We replicated the analysis by splitting the sample into two groups: micro–small firms and medium–large firms. In this way, we tested for heterogeneous effects of the EU Taxonomy across firms’ size category, which is an important dimension that shapes investment decisions and patterns.

Table 5 provides supporting results for Hypothesis 2.2. We found that the interaction term was statistically significant only for medium and large firms operating in sectors with a higher level of precision (NACE 4 digits), while micro and small firms did not increase their investments. This evidence accords with the previous studies suggesting that larger firms can deal better with uncertainty and have easier access to external funding (Berger & Udell 1998, Ghosal & Loungani 2000). The null effect of the EU Taxonomy when sectors are defined with less precision (TAXONOMY_B=2) was confirmed for both micro–small firms and medium–large firms.o

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Micro–small | Medium–large | Micro–small | Medium–large | Micro–small | Medium–large | |

| Variables | INV | INV | INV | INV | INV | INV |

| SALES_GR | 0.0064*** | 0.0050*** | 0.0064*** | 0.0052*** | 0.0059*** | 0.0050*** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| ROA | 0.0356*** | 0.0623*** | 0.0358*** | 0.0623*** | 0.0373*** | 0.0630*** |

| (0.006) | (0.004) | (0.006) | (0.004) | (0.006) | (0.004) | |

| ASSETS | −1.6492*** | −0.7775*** | −1.6457*** | −0.7735*** | −2.0472*** | −0.8894*** |

| (0.071) | (0.032) | (0.071) | (0.032) | (0.082) | (0.036) | |

| CASH | −0.0018 | 0.0206*** | −0.0018 | 0.0206*** | 0.0010 | 0.0256*** |

| (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | (0.003) | |

| LEVERAGE | 0.0089*** | 0.0189*** | 0.0090*** | 0.0190*** | 0.0077*** | 0.0190*** |

| (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | |

| TAXONOMY_B=1 (4 digits) | 0.9188*** | −0.1421 | 0.9141*** | −0.1361 | 1.5748*** | −0.1633 |

| (0.188) | (0.108) | (0.189) | (0.108) | (0.313) | (0.178) | |

| TAXONOMY_B=2 (2–3 digits) | 0.9978*** | 0.6014*** | 0.9856*** | 0.6085*** | 1.4787*** | 0.3516 |

| (0.147) | (0.096) | (0.148) | (0.096) | (0.471) | (0.280) | |

| TAXONOMY_B=1 (4 digits)×POST | 0.4621 | 0.6438*** | 0.4848 | 0.6290*** | 0.4498 | 0.6208*** |

| (0.367) | (0.193) | (0.369) | (0.195) | (0.368) | (0.194) | |

| TAXONOMY_B=2 (2–3 digits)×POST | 0.2302 | −0.0951 | 0.2398 | −0.1109 | 0.1424 | −0.0732 |

| (0.243) | (0.160) | (0.249) | (0.162) | (0.249) | (0.162) | |

| Constant | 16.8352*** | 8.8183*** | 16.7952*** | 8.7686*** | 20.2478*** | 9.9806*** |

| (0.708) | (0.367) | (0.708) | (0.367) | (0.814) | (0.410) | |

| Observations | 107,197 | 246,387 | 107,196 | 246,387 | 107,196 | 246,387 |

| R-squared | 0.0375 | 0.0216 | 0.0389 | 0.0241 | 0.0459 | 0.0281 |

| Year FE | Yes | Yes | No | No | No | No |

| Country FE | Yes | Yes | No | No | No | No |

| Year×Country FE | No | No | Yes | Yes | Yes | Yes |

| Sector FE | No | No | No | No | Yes | Yes |

5.2. Robustness

In this section, we conduct several robustness tests to confirm the main findings. The results are shown in Appendix (Table A.3).

All previous results were obtained by conditioning on sector fixed effects. Still, there might be changes in investment that somehow stem from sectorial trends or differences that are unrelated to the EU Taxonomy. Panel A shows the estimates that use sector variables to control for growth opportunities in that sector. By using Eurostat data at the sector (country) level, we included Sector Turnover (defined as the turnover divided by the number of employees) and Sector High-growth (computed as the share of high-growth firms divided by the number of active firms in that sector).p In Panel B, we clustered standard errors at the sector level and found that our results still held.

Even though controlling for country × year fixed effects reduce worries about country trends that may cause different investment patterns, we add two country variables as a further check. GDP per capita captures the macro-economic condition of a country, while Renewable Energy (defined as the share of energy produced with renewable resources) approximates countries’ efforts towards sustainable energy production, which may directly or indirectly drive new investment strategies. Panel C shows that our findings were unaltered by these additions.

As mentioned by Badertscher et al. (2013) another concern is that ROA and ASSETS are correlated with growth opportunities. In Panel D, we dropped both variables and the coefficients of interest remained positive and statistically significant.

Finally, to limit the role of confounding factors caused by differences in the treated and untreated groups, we used comparable firms as a counterfactual. We selected firms that were as similar as possible to the treated companies in their economic and financial characteristics, except for the fact that they were not in a sector that was EU Taxonomy-eligible. After excluding firms with Taxonomy_B=2, we matched firms with Taxonomy-eligible sector at the 4-digit level (TAXONOMY_B=1) based on the control variables of Eq. (1) with firms operating in non-eligible sectors. The matching procedures picks those firms that are most similar in the year prior the Taxonomy. We performed the matching using a coarsened exact matching methodology (Iacus et al. 2012), which compared to other matching methods reduces the imbalance in the empirical distribution of the confounders between the treated and control groups, thereby minimizing the concerns of biased statistical inferences. Table A.4 in Appendix reports the estimates derived from this procedure; the results were consistent with our main findings.

6. Conclusion

The EU Taxonomy for sustainable activities is the first comprehensive classification, designed to identify the extent to which economic activities can be classified as environmentally sustainable, based on contributions to environmental objectives and technical criteria. The related EU TR introduced mandatory, sustainability-linked transparency requirements for large companies and financial market participants. The expectation is that these requirements will encourage more investments in low-carbon technologies and thereby support the EU’s climate goals via a reduction of information asymmetries.

In this paper, we investigated whether the EU Taxonomy, in its early release, stimulated firms to align with the sustainability criteria and avoid missing out on financing opportunities. Our results show that the inclusion of the firms’ NACE sector into the list of EU Taxonomy-eligible ones has not, by itself, prompted a significant increase in corporate investment compared to non-eligible firms. Furthermore, since the TEG has identified a list of Taxonomy-eligible activities with different levels of detail, we argue that firms operating in various sectors do not face the same degree of uncertainty. As a result, we found that when firms’ eligible sector is defined at the level of NACE 4 digits, companies face lower uncertainty and thus pursue greater investment. This evidence aligns with the previous studies arguing that uncertainty causes firms to postpone investments so they can wait for new information (Pindyck 1991, 1993, Dixit & Pindyck 1994). Finally, given the same level of Taxonomy-eligibility uncertainty, we further explored the effect of size on corporate investments. We found that medium and large companies increased their investment more compared to small ones, providing evidence that firms can react differently to uncertainty depending on their size. To explain these results, we rely on growing regulatory pressure (EBA 2019) and peer behavior effects may have contributed to the documented increased investments. The role played by each channel is however empirically hard to isolate, still our evidence provides several important contributions. In addition, our findings complement recent contributions to the emerging area of sustainable finance concerning green debt instruments and to corporate financing for the environment more generally (see e.g. Barua & Chiesa 2019, Delis et al. 2019, Palea & Drogo 2020, Lemma et al. 2021, Tan et al.2021).

From a policy perspective, our paper evaluates the impact of the EU Taxonomy, which may be of interest to EU regulators looking to further develop the European sustainable strategy. Our results are also of interest for the policymakers of other countries who are seeking to adopt their own sustainable or green classifications, as well as engage in coordinated actions at the international level.

Our study has two main limitations that represent open venues for future research. First, the analysis relied on a limited observation period (2015–2019), which was a compelling choice due to the heterogenous impact of the COVID-19 crisis in 2020 (and beyond) on firms’ balance sheets. Second, our dependent variable came from companies’ balance sheet data as displayed by current data providers. While this information allowed us to investigate the impact of the EU Taxonomy in all 27 Member States, the lack of detail on specific investments kept us from disentangling green investments from other corporate investments. Alternative data sources suffer from other drawbacks. For example, Thomson Reuters and Bloomberg provide detailed data on environmental investments for a very limited set of companies (mainly listed ones), which would have impeded our understanding of how company size related to Hypothesis 2.2.

Therefore, future research will be firstly addressed to amend the lack of green data on companies’ balance sheets by surveying firms in a selection of European countries. With these data available, we will study the reaction of listed and non-listed companies by observing indicators that are relevant for EU Taxonomy enforcement, such as Taxonomy-aligned turnover, capital expenditure or operating expense. This will also provide a chance to overcome the time constraints stemming from COVID-19. Third, we will observe the companies’ reactions to the enlarged reporting requirements of the Non-Financial Reporting Directive (NFRD; Directive 2014/95/EU), which accompanies the recent proposal (21 April 2021) for a Corporate Sustainability Reporting Directive (CSRD). Finally, we will study the market reactions of financial institutions and intermediaries depending on whether their sustainable financial products (e.g. investments and lending flows in ESG companies) are indeed aligned with the criteria imposed by the EU Taxonomy.

Notes

a Nomenclature statistique des Activité économiques dans la Communauté Européenne.

b Under the Taxonomy Regulation, the Commission has to come up with the actual list of environmentally sustainable activities by defining technical screening criteria for each environmental objective through delegated acts. See https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

c These technical screening criteria are developed in delegated acts (see later on in this section).

d In October 2020, the TR created a platform on sustainable finance with a balanced representation of public and private, financial and non-financial stakeholders. Through their feedback, these stakeholders assisted the Commission in developing the EU Taxonomy for the remaining environmental objectives, as well as updating the technical screening criteria and the list of activities for all objectives.

e For each economic activity considered, the TR features delegated acts that offer detailed technical screening criteria and define the environmental performance requirements that ensure an activity makes a “substantial contribution” and DNSH. See Table B.2 in the appendix for further details.

f Namely those who fall under the scope of the Non-Financial Reporting Directive (Directive 2014/95/EU).

g For more details, see https://finance.ec.europa.eu/regulation-and-supervision/financial-services-legislation/implementing-and-delegated-acts/taxonomy-regulation_en

h We omitted the sector Mining and quarrying (B) in order to postpone its evaluation for a future analysis.

i While a company could operate in more than one sector, the main NACE is a good proxy for the most important sector of activity.

j The database was accessed in September 2021.

k All variables are defined in Table A.1 in Appendix.

l We can only identify firms operating in eligible sectors based on whether firms fulfil the three conditions listed in Sec. 2 and comply with the technical screening criteria. Data on firms with Taxonomy-aligned activities will be available once firms declare the exact percentage, if any, of turnover.

m Companies operating in a Taxonomy-eligible NACE sector at the 3-digit level represent only 2% of the sample (2088 observations in 2019); hence, we collapsed the 2- and 3-digit sectors into the same category.

n We adopt the definition of the European Commission based on the number of employees, turnover and total assets https://ec.europa.eu/growth/smes/sme-definition_it.

o By replicating the analysis with TAXONOMY_A, we found that the interaction terms were not statistically significant for micro/small firms and even for medium/large firms (see Appendix Table A.2). This further corroborates the importance of a precise definition at the sector level of taxonomy eligibility.

p The European Commission defines high-growth firms as those with at least 10 employees at their onset and an average annualized growth in the number of employees greater than 10% per annum, over a three-year period.

Appendix A

| Definition | Source | |

|---|---|---|

| Dependent variables | ||

| INV | Change in fixed assets from year t−1 to t, divided by total assets in year t−1 | Amadeus |

| Control variables | ||

| TAXONOMY_A | Dummy variable equal to 1 if a firm operates in a Taxonomy eligible sector based on NACE sectors with a detail at 2, 3 or 4 digits, and 0 otherwise | European Commission |

| TAXONOMY_B | TAXONOMY_B taking the value 1 if firm i is in a Taxonomy-eligible sector defined at NACE 4 digits, 2 if firm i is in a Taxonomy-eligible sector defined at NACE 2 or 3 digits, and 0 otherwise | European Commission |

| SALES_GR | Change in sales from year t−1 to year t in percentage | Amadeus |

| ROA | Profit and losses before taxes, divided by total assets in year t−1 | Amadeus |

| ASSETS | Natural logarithm of total assets in t−1 | Amadeus |

| CASH | Cash and cash equivalents divided by total assets in year t−1 | Amadeus |

| LEVERAGE | Total liabilities divided by total assets in year t−1 | Amadeus |

| Additional control variables | Amadeus | |

| Sector Turnover | Turnover divided by the number of employees defined at sector-country level | Eurostat |

| Sector High-growth | Share of high-growth firms divided by the number of active firms in a specific sector-country | Eurostat |

| GDP | Gross Domestic Product per capita | Eurostat |

| Renewable Energy | Share of energy produced with renewable resources | Eurostat |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Micro–small | Medium–large | Micro–small | Medium–large | Micro–small | Medium–large | |

| Variables | INV | INV | INV | INV | INV | INV |

| SALES_GR | 0.0064*** | 0.0051*** | 0.0064*** | 0.0053*** | 0.0059*** | 0.0050*** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| ROA | 0.0356*** | 0.0624*** | 0.0358*** | 0.0625*** | 0.0373*** | 0.0629*** |

| (0.006) | (0.004) | (0.006) | (0.004) | (0.006) | (0.004) | |

| ASSETS | −1.6489*** | −0.7749*** | −1.6456*** | −0.7709*** | −2.0479*** | −0.8892*** |

| (0.071) | (0.032) | (0.071) | (0.032) | (0.082) | (0.036) | |

| CASH | −0.0018 | 0.0211*** | −0.0018 | 0.0210*** | 0.0010 | 0.0255*** |

| (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | (0.003) | |

| LEVERAGE | 0.0089*** | 0.0189*** | 0.0090*** | 0.0190*** | 0.0077*** | 0.0190*** |

| (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | |

| TAXONOMY_A=1 (4-3-2 digits) | 0.9719*** | 0.3198*** | 0.9617*** | 0.3256*** | 1.5855*** | 0.0118 |

| (0.127) | (0.078) | (0.128) | (0.078) | (0.275) | (0.162) | |

| TAXONOMY_A=1 (4-3-2 digits)×POST | 0.3046 | 0.1803 | 0.3215 | 0.1682 | 0.2448 | 0.1842 |

| (0.221) | (0.134) | (0.228) | (0.135) | (0.227) | (0.135) | |

| Constant | 16.8315*** | 8.7837*** | 16.7943*** | 8.7335*** | 20.2219*** | 10.0388*** |

| (0.706) | (0.367) | (0.707) | (0.367) | (0.813) | (0.409) | |

| Observations | 107,197 | 246,387 | 107,196 | 246,387 | 107,196 | 246,387 |

| R-squared | 0.0375 | 0.0215 | 0.0389 | 0.0239 | 0.0459 | 0.0280 |

| Year FE | Yes | Yes | No | No | No | No |

| Country FE | Yes | Yes | No | No | No | No |

| Year×Country FE | No | No | Yes | Yes | Yes | Yes |

| Sector FE | No | No | No | No | Yes | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| INV | INV | INV | |

| All | Micro–small | Medium–large | |

| Panel A: sector controls | |||

| TAXONOMY_B=1 (4 digits)×POST | 0.5360*** | 0.4739 | 0.6385*** |

| (0.173) | (0.369) | (0.195) | |

| TAXONOMY_B=2 (2–3 digits)×POST | −0.0161 | 0.1764 | −0.0038 |

| (0.139) | (0.260) | (0.167) | |

| Sector turnover | 0.5122** | 0.8105* | 0.3690 |

| (0.226) | (0.493) | (0.244) | |

| Sector high growth | 0.0887*** | 0.0472 | 0.1033*** |

| (0.021) | (0.041) | (0.024) | |

| Observations | 342,445 | 102,779 | 239,665 |

| R-squared | 0.0292 | 0.0434 | 0.0262 |

| Firms controls | Yes | Yes | Yes |

| Year FE | No | No | No |

| Country FE | No | No | No |

| Year×Country FE | Yes | Yes | Yes |

| Sector FE | Yes | Yes | Yes |

| Panel B: standard errors clustered at sector level | |||

| TAXONOMY_B=1 (4 digits)×POST | 0.5205*** | 0.4498*** | 0.6208*** |

| (0.161) | (0.199) | (0.208) | |

| TAXONOMY_B=2 (2–3 digits) ×POST | −0.0632 | 0.1424 | −0.0732 |

| (0.170) | (0.260) | (0.216) | |

| Observations | 353,584 | 107,196 | 246,387 |

| R-squared | 0.0311 | 0.0459 | 0.0281 |

| Firms controls | Yes | Yes | Yes |

| Year FE | No | No | No |

| Country FE | No | No | No |

| Year×Country FE | Yes | Yes | Yes |

| Sector FE | Yes | Yes | Yes |

| Panel C: country controls | |||

| TAXONOMY_B=1 (4 digits)×POST | 0.5202*** | 0.4343 | 0.6334*** |

| (0.171) | (0.367) | (0.193) | |

| TAXONOMY_B=2 (2–3 digits)×POST | −0.0865 | 0.1544 | −0.0964 |

| (0.133) | (0.245) | (0.161) | |

| GDP | −0.0092 | −0.0183 | 0.0000 |

| (0.022) | (0.043) | (0.025) | |

| Renewable energy | 0.2377*** | −0.0058 | 0.3178*** |

| (0.063) | (0.134) | (0.071) | |

| Observations | 353,584 | 107,197 | 246,387 |

| R-squared | 0.0282 | 0.0430 | 0.0244 |

| Firms controls | Yes | Yes | Yes |

| Year FE | No | No | No |

| Country FE | No | No | No |

| Year×Country FE | Yes | Yes | Yes |

| Sector FE | Yes | Yes | Yes |

| Panel D: without ROA and ASSETS | |||

| TAXONOMY_B=1 (4 digits)×POST | 0.5544*** | 0.4673 | 0.6566*** |

| (0.173) | (0.372) | (0.195) | |

| TAXONOMY_B=2 (2–3 digits)×POST | −0.0597 | 0.0066 | −0.0167 |

| (0.135) | (0.252) | (0.163) | |

| Observations | 353,584 | 107,196 | 246,387 |

| R-squared | 0.0215 | 0.0281 | 0.0198 |

| Other firms controls | Yes | Yes | Yes |

| Year FE | No | No | No |

| Country FE | No | No | No |

| Year× Country FE | Yes | Yes | Yes |

| Sector FE | Yes | Yes | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | INV | INV | INV |

| SALES_GR | 0.0025** | 0.0026** | 0.0026** |

| (0.001) | (0.001) | (0.001) | |

| ROA | 0.0972*** | 0.0969*** | 0.0960*** |

| (0.007) | (0.007) | (0.007) | |

| ASSETS | −0.5503*** | −0.5488*** | −0.5313*** |

| (0.040) | (0.040) | (0.042) | |

| CASH | 0.0265*** | 0.0263*** | 0.0292*** |

| (0.005) | (0.005) | (0.005) | |

| LEVERAGE | 0.0121*** | 0.0122*** | 0.0121*** |

| (0.002) | (0.002) | (0.002) | |

| TAXONOMY_B=1 (4 digits) | −0.1641* | −0.1642* | −0.4652*** |

| (0.095) | (0.095) | (0.177) | |

| TAXONOMY_B=1 (4 digits)×POST | 0.7697*** | 0.7753*** | 0.7775*** |

| (0.177) | (0.178) | (0.178) | |

| Constant | 6.3071*** | 6.2830*** | 6.1652*** |

| (0.476) | (0.473) | (0.499) | |

| Observations | 192,730 | 192,730 | 192,730 |

| R-squared | 0.0212 | 0.0241 | 0.0263 |

| Year FE | Yes | No | No |

| Country FE | Yes | No | No |

| Year×Country FE | No | Yes | Yes |

| Sector FE | No | No | Yes |

Appendix B

| Date | Subject (issuer) | Document/Event | Content |

|---|---|---|---|

| September 2016 | The European Commission | Communication from the CommissionCapital Markets Union — Accelerating Reform | The European Commission established an HELG on sustainable finance in December 2016. The HLEG comprised 20 senior experts from civil society, the finance sector, academia and observers from European and international institutions. The group was mandated to provide advice to the Commission on how to steer the flow of public and private capital towards sustainable investments. |

| July 2017 | HLEG | Interim report of the HELG on sustainable finance — Financingasustainable European economy | The questionnaire developed by the HLEG was an opportunity for stakeholders to provide targeted input to help shape the Sustainable Finance discussion in the European Union. |

| 31 January 2018 | HLEG | Final report of the HELG on sustainable finance | The Report argues that sustainable finance is about two urgent imperatives: (i) improving the contribution of finance to sustainable and inclusive growth by funding society’s long-term needs; (ii) strengthening financial stability by incorporating environmental, social and governance (ESG) factors into investment decision-making. |

| March 2018 | The European Commission | Communication from the Commission to the European Parliament, the European Council, The Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions Action plan: Financing sustainable growth | The Action Plan aims to: 1. Reorient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth 2. Manage financial risks stemming from climate change, resource depletion, environmental degradation and social issues; and 3. Foster transparency and long-termism in financial and economic activity |

| July 2018 | The TEG commenced its work | The TEG comprised 35 members from civil society, academia, business and the finance sector, as well as additional members and observers from EU and international public bodies work both through formal plenaries and subgroup meetings for each workstream. | |

| December 2018–February 2019 | TEG | Taxonomy pack for feedback and workshops invitations | In December 2018, the TEG published an early feedback report onafirst set of climate change mitigation activities and their technical screening criteria, together withacall for feedback on the proposed criteria.In the first half of 2019, the TEG also engaged with over 200additional experts to develop technical screening criteria for the second round of climate change mitigation and adaptation activities. |

| 18 June 2019 | TEG | Taxonomy Technical Report | The TEG published a report on EU Taxonomy, which takes on board the feedback received on the first round of proposed activities and the input from the additional experts. The report is accompanied by a short user guide, which provides a quick overview of what the taxonomy is, what it is not, and how to use it in practice. |

| 24 June 2019 | The European Commission | EVENT: Stakeholder dialogue | Commission organizedastakeholder dialogue on sustainable finance. In addition to the reports ofthe TEG, during the event the Commission presented thenew guidelines for companies on how to reportclimate-related information. |

| From 3 July to 16 September 2019 | TEG | Call for feedback | The TEGacall for feedback on its report on EU taxonomy held from 3 July to 16 September 2019. In the autumn, the TEG analyzed the responses and advise the Commission on how to take the feedback forward. |

| 09 March 2020 | TEG | TEG final report on the EU taxonomy + Technical annex to the TEG final report on the EU taxonomy | The TEG on Sustainable Finance published its final reports on an EU taxonomy (including technical annex) |

| 12 March 2020 | The European Commission | EVENT: Stakeholder dialogue | In order to present and discuss the final reports of the TEG on the EU taxonomy as well as further user guidance in relation to its recommendations for an EU Green Bond Standard, the Commission hosted a web-based stakeholder dialogue on 12 March 2020. |

| 12 July 2020 | The TR (Regulation (EU) 2020/852) | The TR for climate change mitigation and adaptation, converting to law, the EU taxonomy entered into force |

| Date | Act | Content |

|---|---|---|

| 21 April 2021 | Delegated Acts for Regulation (EU) 2020/852 on sustainable activities for climate change adaptation and mitigation objectives: EU Taxonomy Climate Delegated Act | A first delegated act on sustainable activities for climate change adaptation and mitigation objectives was approved in principle on 21 April 2021, and formally adopted on 4 June 2021 for scrutiny by the co-legislators. A second delegated act for the remaining objectives will be published in 2022. |

| 6 July 2021 | Delegated regulation supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation | This delegated act specifies the content, methodology and presentation of information to be disclosed by financial and non-financial undertakings concerning the proportion of environmentally sustainable economic activities in their business, investments or lending activities. |