System Upgrade on Tue, May 28th, 2024 at 2am (EDT)

Existing users will be able to log into the site and access content. However, E-commerce and registration of new users may not be available for up to 12 hours.For online purchase, please visit us again. Contact us at customercare@wspc.com for any enquiries.

In the field of financial risk management, the 'sell side' is the set of financial institutions who offer risk management products to corporations, governments, and institutional investors, who comprise the 'buy side'. The sell side is often at a significant advantage as it employs quantitative experts who provide specialized knowledge. Further, the existing body of knowledge on risk management, while extensive, is highly technical and mathematical and is directed to the sell side.

This book levels the playing field by approaching risk management from the buy side instead, focusing on educating corporate and institutional users of risk management products on the essential knowledge they need to be an intelligent buyer. Rather than teach financial engineering, this volume covers the principles that the buy side should know to enable it to ask the right questions and avoid being misled by the complexity often presented by the sell side.

Written in a user-friendly manner, this textbook is ideal for graduate and advanced undergraduate classes in finance and risk management, MBA students specializing in finance, and corporate and institutional investors. The text is accompanied by extensive supporting material including exhibits, end-of-chapter questions and problems, solutions, and PowerPoint slides for lecturers.

Sample Chapter(s)

Preface

Chapter 1: Introduction and Overview

Contents:

- Introductory Concepts:

- Introduction and Overview

- Understanding the Nature of Risk

- Principles of Risk, Return, and Financial Decision Making

- Basic Concepts of Financial Risk Management

- The Financial Risk Management Environment

- The Value of Risk Management and Hedging

- Measuring Financial Market Risk

- Managing Market Risk with Forward and Futures Contracts

- Managing Market Risk with Swaps

- Managing Market Risk with Options

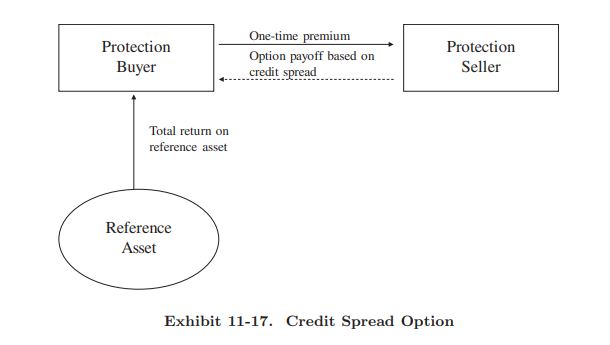

- Managing Credit Risk

- Managing Operational and Other Risks

- Accounting and Disclosure in Financial Risk Management

- Organizational Structure and Corporate Governance of Financial Risk Management

Readership: Graduate and advanced undergraduate classes in finance and risk management, MBA students specialising in finance, and corporate and institutional investors.