Volume 2 is about statistical methods related to structural change in time series models. The approach adopted is off-line whereby one wants to test for structural change using a historical dataset and perform hypothesis testing. A distinctive feature is the allowance for multiple structural changes. The methods discussed have, and continue to be, applied in a variety of fields including economics, finance, life science, physics and climate change. The articles included address issues of estimation, testing and/or inference in a variety of models: short-memory regressors and errors, trends with integrated and/or stationary errors, autoregressions, cointegrated models, multivariate systems of equations, endogenous regressors, long-memory series, among others. Other issues covered include the problems of non-monotonic power and the pitfalls of adopting a local asymptotic framework. Empirical analyses are provided for the US real interest rate, the US GDP, the volatility of asset returns and climate change.

Chapter 15, Figure 2 Aggregated radiative forcing series. Time series plot of RFGHG, TRF* and TRF and the fitted trend functions with two breaks: 1960 and 1994 for RFGHG, 1960 and 1992 for TRF* , 1960 and 1991 for TRF.  |

|

Chapter 5, Figure 1 Annual log per capita gross domestic product (GDP): 1870–1986. The fitted trend function is obtained by regressing the series on a constant, a trend, an intercept shift and a slope shift where the break date is selected by minimizing the sum of squared residuals from the regression (see Model II).  |

|

Chapter 1, Figure 3 Power function of QDT (0) against a change in mean, T = 100, 5% nominal size.  |

|

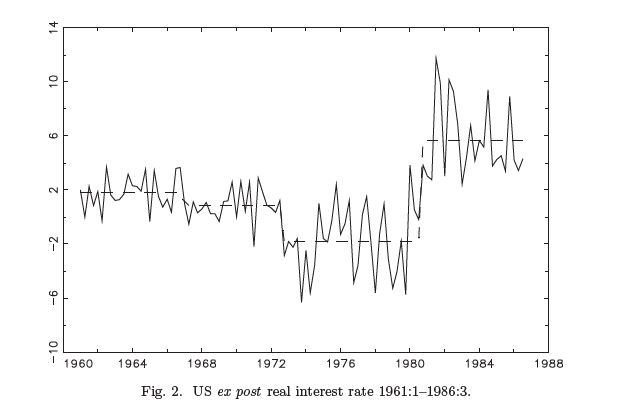

Chapter 3, Figure 2 US ex post real interest rate 1961:1–1986:3.  |

|

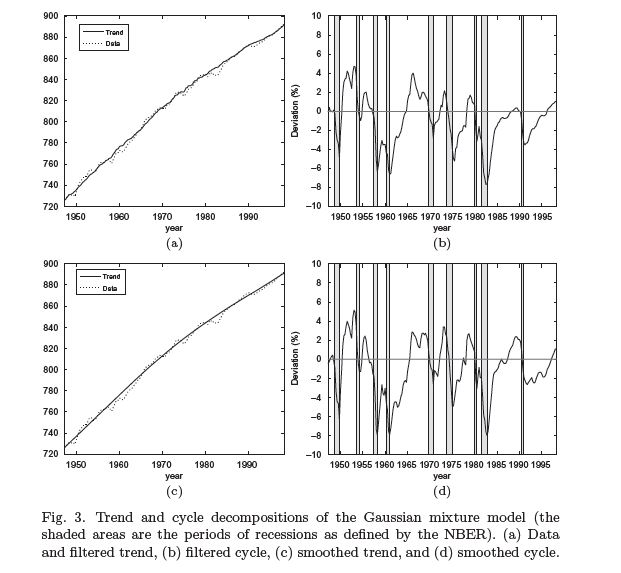

Chapter 10, Figure 3 Trend and cycle decompositions of the Gaussian mixture model (the shaded areas are the periods of recessions as defined by the NBER). (a) Data and filtered trend, (b) filtered cycle, (c) smoothed trend, and (d) smoothed cycle.  |

- A Test for Changes in a Polynomial Trend Function for a Dynamic Time Series (Pierre Perron)

- An Analysis of the Real Interest Rate Under Regime Shifts (René Garcia and Pierre Perron)

- Estimating and Testing Linear Models with Multiple Structural Changes (Jushan Bai and Pierre Perron)

- Computation and Analysis of Multiple Structural Change Models (Jushan Bai and Pierre Perron)

- Structural Breaks with Deterministic and Stochastic Trends (Pierre Perron and Xiaokang Zhu)

- Estimating Restricted Structural Change Models (Pierre Perron and Zhongjun Qu)

- Estimating and Testing Structural Changes in Multivariate Regressions (Zhongjun Qu and Pierre Perron)

- The Limit Distribution of the Estimates in Cointegrated Regression Models with Multiple Structural Changes (Mohitosh Kejriwal and Pierre Perron)

- Assessing the Relative Power of Structural Break Tests Using a Framework Based on the Approximate Bahadur Slope (Dukpa Kim and Pierre Perron)

- Let's Take a Break: Trends and Cycles in US Real GDP (Pierre Perron and Tatsuma Wada)

- Testing for Shifts in Trend with an Integrated or Stationary Noise Component (Pierre Perron and Tomoyoshi Yabu)

- A Sequential Procedure to Determine the Number of Breaks in Trend with an Integrated or Stationary Noise Component (Mohitosh Kejriwal and Pierre Perron)

- Testing for Multiple Structural Changes in Cointegrated Regression Models (Mohitosh Kejriwal and Pierre Perron)

- Wald Tests for Detecting Multiple Structural Changes in Persistence (Mohitosh Kejriwal, Pierre Perron and Jing Zhou)

- Statistically Derived Contributions of Diverse Human Influences to Twentieth-Century Temperature Changes (Francisco Estrada, Pierre Perron and Benjamín Martínez-López)

- A Note on Estimating and Testing for Multiple Structural Changes in Models with Endogenous Regressors via 2SLS (Pierre Perron and Yohei Yamamoto)

- Using OLS to Estimate and Test for Structural Changes in Models with Endogenous Regressors (Pierre Perron and Yohei Yamamoto)

- Long-Memory and Level Shifts in the Volatility of Stock Market Return Indices (Pierre Perron and Zhongjun Qu)

- Modeling and Forecasting Stock Return Volatility Using a Random Level Shift Model (Yang K Lu and Pierre Perron)

- Forecasting Return Volatility: Level Shifts with Varying Jump Probability and Mean Reversion (Jiawen Xu and Pierre Perron)